Pig Iron Price Trends 2025: Market Analysis, Forecast & Investment Insights

2025-08-26 15:02:42 hits:0

Introduction to Pig Iron and Its Market Value

Pig iron, often considered the backbone of the steel industry, is a crucial raw material in the production of various grades of steel. Understanding pig iron pricing is essential for manufacturers, traders, and investors because fluctuations directly impact the global steel supply chain.

In recent years, the pig iron market has experienced dynamic changes driven by raw material shortages, rising energy costs, and geopolitical events. As of 2025, monitoring pig iron prices has become even more critical for predicting future trends in the steel industry.

What is Pig Iron?

Composition and Characteristics

Pig iron is a basic form of iron obtained by smelting iron ore in a blast furnace. It typically contains 3–4% carbon, along with varying amounts of silicon, manganese, and sulfur. Due to its high carbon content, pig iron is brittle and cannot be directly used in most applications.

Difference Between Pig Iron, Wrought Iron, and Steel

Pig Iron: High carbon, brittle, intermediate product.

Wrought Iron: Low carbon, malleable, mainly historical use.

Steel: Refined pig iron with controlled carbon and alloying elements, making it stronger and more versatile.

Importance of Pig Iron in the Global Steel Industry

Role in Steelmaking

Pig iron serves as a vital feedstock for steelmaking. It is refined in a basic oxygen furnace (BOF) or electric arc furnace (EAF) to produce steel of various grades.

Key Industries Dependent on Pig Iron

Construction: Rebar, structural steel, and bridges.

Automotive: Vehicle frames, engine blocks.

Machinery: Heavy equipment, tools, and manufacturing machines.

Current Pig Iron Price Overview

Global Price Averages

As of mid-2025, pig iron prices fluctuate between $410 – $480 per metric ton (MT), depending on quality and region.

Regional Price Variations

Asia (China, India): Typically lower due to strong domestic supply.

Europe: Higher because of import dependence and stricter energy policies.

USA: Prices influenced by tariffs and reliance on imports from Brazil and Ukraine.

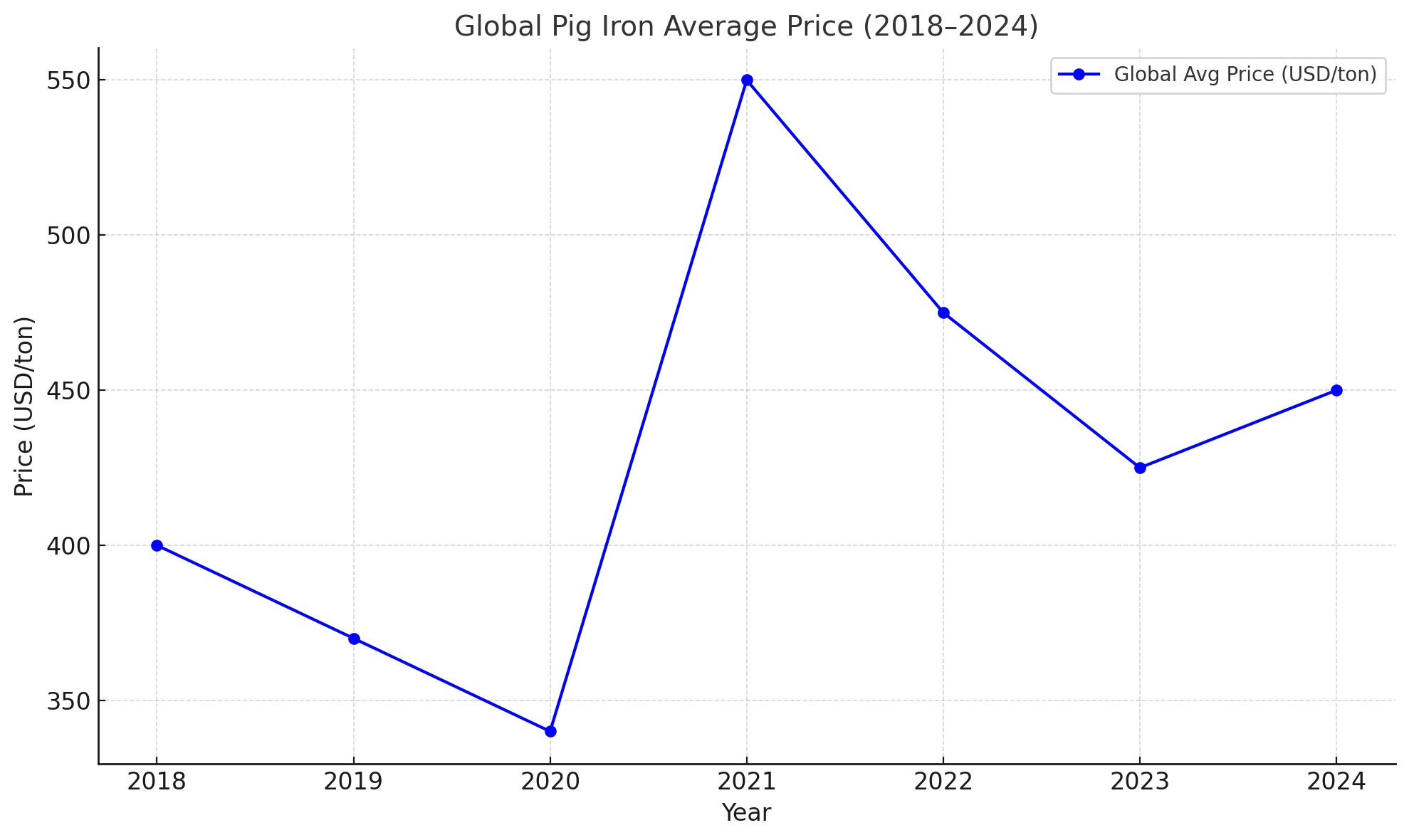

📊 Global Pig Iron Annual Average Price (2018–2024)

| Year | Global Avg. Price (USD/ton) | China Domestic Price (CNY/ton) | Key Drivers |

|---|---|---|---|

| 2018 | 380–420 | 2,800–3,200 | US-China trade war caused supply chain disruptions; China’s environmental production limits pushed up domestic prices |

| 2019 | 350–390 | 2,600–3,000 | Global steel overcapacity; Brazil mining accident led to short-term iron ore price spike (pig iron price restrained) |

| 2020 | 320–360 | 2,400–2,800 | COVID-19 demand shock; China’s rapid resumption of work supported the price bottom |

| 2021 | 520–580 | 3,800–4,500 | Global energy crisis + iron ore reached record high ($230/ton); China’s “dual-carbon” policy limited crude steel output |

| 2022 | 450–500 | 3,200–3,800 | Russia-Ukraine conflict pushed up energy costs; European steel production cut; China’s demand slowed |

| 2023 | 400–450 | 2,900–3,400 | Global inflation pressure; India demand surge (12% infrastructure investment growth); Brazil exports increased 15% |

| 2024 | 420–480 | 3,100–3,600 | Expected support from China’s real estate recovery and India’s election-year infrastructure stimulus; iron ore price fluctuation range $80–120/ton |

Recent Price Fluctuations (2024–2025)

Prices surged in early 2024 amid rising energy costs but stabilized later that year as raw material supply normalized. In 2025, forecasts suggest steady demand with slight upward pressure on prices.

Factors Affecting Pig Iron Prices

Pig iron prices don’t move randomly; they’re influenced by a mix of industrial, economic, and geopolitical forces. Anyone involved in trading or manufacturing needs to understand these drivers.

Raw Material Costs (Iron Ore & Coking Coal)

The two main inputs for pig iron are iron ore and coking coal. If iron ore prices spike due to supply chain disruptions or mining restrictions, pig iron costs rise accordingly. Similarly, fluctuations in coking coal prices, often tied to export policies in Australia and India, have a direct effect.

Global Supply and Demand

When construction activity in China and India ramps up, pig iron demand—and thus prices—tends to soar. Conversely, during global economic slowdowns, demand dips, leading to price reductions.

Energy Prices and Transportation Costs

Blast furnaces consume massive amounts of energy. Rising natural gas, electricity, or oil prices directly increase pig iron production costs. Transportation expenses, especially shipping rates, also contribute to regional price variations.

Government Policies and Trade Tariffs

Import duties, sanctions, and trade wars can significantly alter pig iron costs. For example, tariffs imposed by the U.S. on steel-related products often ripple back to pig iron markets.

Pig Iron Production and Major Exporting Countries

Top Producers: China, India, Brazil, Russia

China: The world’s largest producer and consumer of pig iron.

India: Significant growth due to rising steel demand.

Brazil: Strong exporter, especially to the United States.

Russia: Major supplier, though impacted by sanctions and logistics challenges.

Leading Exporters and Importers

Exporters: Brazil, Ukraine, Russia, India.

Importers: USA, Turkey, Europe, and Southeast Asia.

| Country | Role | Key Data & Characteristics |

|---|---|---|

| China | Major Producer & Consumer | - Production: ~1.05 billion tons (60% global share) - Exports: <1% of output (domestic demand driven) - Imports: Negligible (self-sufficient >95%) |

| India | Producer & Emerging Exporter | - Production: ~120 million tons (12% global share) - Export Growth: +15% YoY (targeting Ukrainian market gap) - Demand Driver: Infrastructure (railways, housing) |

| Brazil | Major Producer & Top Exporter | - Production: ~80 million tons (8% global share) - Exports: ~60% of output (25% global trade share) - Key Markets: U.S., Europe (high-quality iron ore advantage) |

| Russia | Producer & Volatile Exporter | - Production: ~70 million tons (7% global share) - Exports: Down 30% YoY (sanctions, logistics costs) - Shift: Redirecting flows to China, India |

| Ukraine | Disrupted Exporter | - Pre-war Export Rank: Top 3 (~10% global share) - Current Status: Exports collapsed due to conflict - Historical Markets: Turkey, Italy |

| United States | Largest Importer | - Imports: ~12 million tons annually - Key Suppliers: Brazil (60%), Canada (20%) - Use: Steel production (construction, automotive) |

| Turkey | Top European Importer | - Imports: ~5 million tons annually - Key Suppliers: Russia (pre-war), now diversifying to India, Brazil - Use: Rebar, flat steel manufacturing |

| Germany | Major EU Importer | - Imports: ~3 million tons annually - Challenge: High energy costs reduce domestic output - Key Suppliers: Brazil, Russia (pre-sanctions) |

| Vietnam | Fastest-Growing Importer | - Imports: +20% YoY (2023) - Key Projects: North-South Highway, LNG terminals - Key Suppliers: Brazil, India |

Historical Price Trends of Pig Iron

Price Movement in the Last 10 Years

Over the last decade, pig iron prices have ranged from $250/MT to $700/MT, heavily influenced by global crises such as the COVID-19 pandemic, trade wars, and energy shortages.

Comparison with Scrap Steel Prices

Pig iron competes with scrap steel in steelmaking. When scrap is abundant and cheap, demand for pig iron dips. But in times of scrap shortage, pig iron prices often surge as mills turn to it as an alternative feedstock.

Pig Iron Price Forecast for 2025 and Beyond

Expected Global Demand Growth

Demand is expected to remain stable, with developing economies like India driving growth through large-scale infrastructure projects.

Market Predictions from Industry Analysts

Industry analysts forecast an average $430–$500 per MT price range in 2025, depending on trade stability and energy costs.

Risks and Uncertainties in Pricing

Energy shortages.

Political conflicts disrupting supply.

Global recessionary pressures.

Investment Opportunities in the Pig Iron Market

Pig Iron Futures and Commodity Trading

Pig iron is increasingly traded as a commodity. Investors hedge against steel price volatility by investing in pig iron futures.

How Manufacturers Hedge Against Price Risks

Steelmakers often sign long-term contracts with suppliers to stabilize costs and protect themselves against sudden market surges.

Sustainable Alternatives to Pig Iron

Green Steel Initiatives

With global pressure to reduce carbon emissions, many companies are shifting toward “green steel” production using hydrogen-based methods, which could gradually reduce pig iron’s dominance.

Recycling and Scrap Substitutes

Steel recycling has grown rapidly, and in many regions, recycled scrap serves as a substitute for pig iron in electric arc furnaces.

How to Track Daily Pig Iron Prices

Online Market Platforms

Websites such as Trading Economics, SteelMint, and Fastmarkets provide real-time pig iron price updates.

Industry Reports and Indexes

Industry associations and financial research firms publish regular reports on pig iron trends, making it easier for businesses to forecast.

Frequently Asked Questions (FAQs)

1. What is the current pig iron price?

As of 2025, prices average between $410 – $480 per MT, depending on region and quality.

2. Why is pig iron so important for steelmaking?

Pig iron is the basic raw material used to produce steel, which powers industries from construction to automotive.

3. Which country is the largest producer of pig iron?

China leads the world, accounting for more than 60% of global pig iron production.

4. How does pig iron price compare with scrap steel?

Scrap steel is usually cheaper, but when supply is low, pig iron becomes the preferred option despite higher costs.

5. Will pig iron prices rise in 2025?

Analysts expect a slight upward trend due to steady demand and potential energy cost increases.

6. Can investors trade pig iron directly?

Yes, pig iron is increasingly being traded as a commodity, though futures markets are still developing compared to steel.

Conclusion: Understanding Pig Iron Price Dynamics

Pig iron pricing plays a vital role in shaping the global steel industry. Influenced by raw materials, energy costs, and geopolitical factors, pig iron prices are likely to remain steady with moderate increases in 2025. Manufacturers, traders, and investors who stay informed about these trends can make smarter decisions and safeguard against market risks.

For businesses, monitoring daily prices, diversifying supply sources, and considering sustainable alternatives will be key strategies for navigating the pig iron market in the coming years.

🔗 External Reference: Check live updates on pig iron prices at Trading Economics.

Blog Author Profile

DAWN | Pig Iron & Castings Procurement Advisor 18 years in the foundry trenches give me an edge: I know how pig iron’s chemistry impacts casting quality and can troubleshoot defects like cracks and porosity. With a 1M MT/year pig iron and 60k MT/year casting output from our in-house factory, plus 200+ verified suppliers on our platform, we offer fast price comparisons. Expect a 24-hour inquiry response—my goal? Not just closing deals, but being your go-to partner in the foundry world.

18 years in the foundry trenches give me an edge: I know how pig iron’s chemistry impacts casting quality and can troubleshoot defects like cracks and porosity. With a 1M MT/year pig iron and 60k MT/year casting output from our in-house factory, plus 200+ verified suppliers on our platform, we offer fast price comparisons. Expect a 24-hour inquiry response—my goal? Not just closing deals, but being your go-to partner in the foundry world.

en

en  fra

fra  de

de  ru

ru  ara

ara  gle

gle  it

it  jp

jp  kor

kor  th

th  zh

zh