Global Pig Iron Production Falls in November 2025 – Supply Pressures Rise in Steel Industry

2025-12-29 17:40:42 hits:0

According to the latest statistics from GMK Center, global pig iron production fell to approximately 107.6 million tonnes in November 2025, marking the lowest level for the same month in the past three years. This trend reflects continued contraction in upstream raw material supply within the global steel value chain. (GMK Center)

The decline in production signals a moderate increase in supply-side pressure, particularly in traditional high-output regions where blast furnace operations slowed due to seasonal maintenance, environmental regulations, and weaker downstream demand.

Monthly and Year-on-Year Declines

November 2025: Global pig iron production reached 107.6 million tonnes, down approximately 3% YoY and 3.6% MoM.

Blast Furnace Output: Approximately 96.3 million tonnes, a 4.5% YoY decline.

Direct Reduced Iron (DRI) Output: Approximately 11.3 million tonnes, up 4.3% YoY, but slightly down compared to October 2025.

Blast furnace production remains the primary driver of the overall decline, highlighting the impact of maintenance schedules and environmental limits on high-capacity steel plants.

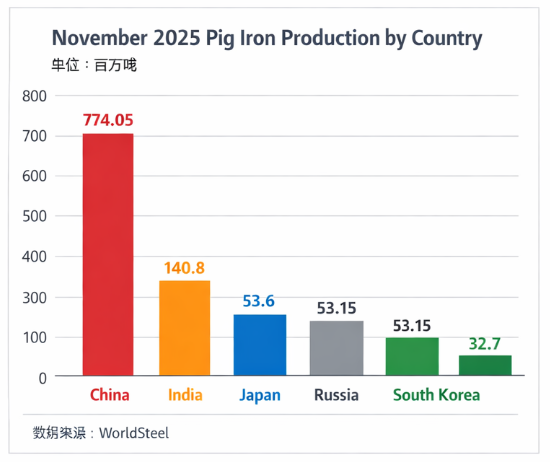

Country-Level Production Analysis

Major producing countries exhibited mixed performance:

China remains the largest producer, with November output at 77.405 million tonnes, down 2.3% YoY.

India increased production by 6.7% YoY to 14.08 million tonnes, demonstrating robust domestic demand.

Japan and Russia experienced declines, producing 5.36 million tonnes (-4%) and 5.315 million tonnes (-1.6%), respectively.

South Korea maintained stable output, with a slight increase of 0.1% YoY.

China’s production trends heavily influence global totals. Recent fluctuations in blast furnace utilization in China, driven by environmental regulations and year-end maintenance, directly affected global pig iron supply.

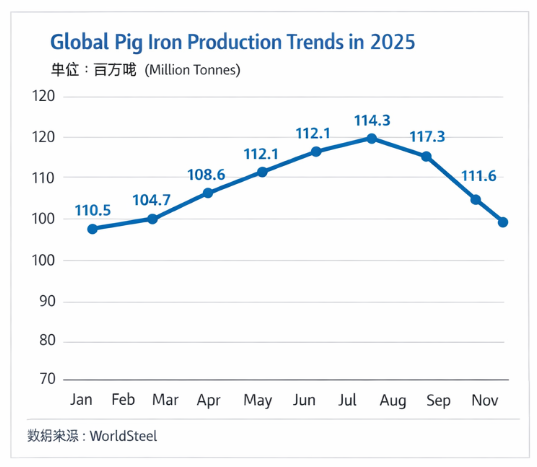

Quarterly Trend: From Summer Peak to Year-End Dip

Looking at recent monthly trends:

August 2025: ~117.3 million tonnes, slight YoY decrease.

October 2025: ~111.6 million tonnes, significant YoY decline.

November 2025: ~107.6 million tonnes, continuing the downward trend.

This pattern reflects seasonal production adjustments, maintenance cycles, and weakened downstream demand.

Market Implications and Supply Chain Impact

Pig iron, as a key upstream raw material in steel production, influences downstream steel supply and pricing. Key implications include:

Rising Supply Pressure: Continued production decline may constrain market availability, potentially increasing raw material costs for steel producers.

Structural Shift in Production Methods: Growth in DRI output indicates a gradual shift toward lower-carbon steelmaking processes, supplementing traditional blast furnace operations.

Downstream Steel Demand Pressure: Slower steel orders from construction and manufacturing sectors reduce pig iron production, reinforcing supply contraction in winter months.

Outlook: Monitoring Trends and Turning Points

While November production reached a low point, future trends may be influenced by:

Year-End and Lunar New Year Maintenance Cycles: Furnace restarts in early 2026 could temporarily boost output.

Raw Material Prices: Fluctuations in iron ore and coking coal prices will affect blast furnace operations.

Trade Policies and Export Environment: Tariffs, quotas, and regulatory measures may alter supply-demand balance. (GMK Center)

Conclusion

The November 2025 data on global pig iron production underscores seasonal and structural challenges in upstream steel supply. With energy costs, environmental regulations, and industry transformation shaping production decisions, the coming months will be critical for assessing trends and market dynamics. Stakeholders should closely monitor production reports and regional policies to anticipate changes in global steel markets.

Data Sources:GMK Center, World Steel Association

Charts: Monthly production trend and country-level output (August–November 2025)

en

en  fra

fra  de

de  ru

ru  ara

ara  gle

gle  it

it  jp

jp  kor

kor  th

th  zh

zh